Feb 2021 House Price Watch

February transactions were at a 14 year high with the rush to complete before the expected end of the stamp duty holiday. And, now that the Chancellor has announced an extension to the stamp duty holiday and a new mortgage guarantee scheme, we also look at what the indices say about house prices and expectations following the budget.

Completed home sales at 14 year high. House prices steady this month and average annual house price growth +6.5%.

HomeOwners Alliance: “In the rush to complete before the end of the stamp duty holiday, February saw completed transactions at a 14 year high. And, with the Chancellor confirming in the budget that the stamp duty holiday will be extended until the end of June (with tapering until October), as well as, the announcement of the new mortgage guarantee scheme, we are likely to see continued robust activity in the housing market. New sales listings have fallen in recent months, likely as a result of lockdown restrictions, whilst demand from homebuyers still motivated to move has held. As a result, we are likely to see rising house prices until the supply of homes for sale catches up with demand.”

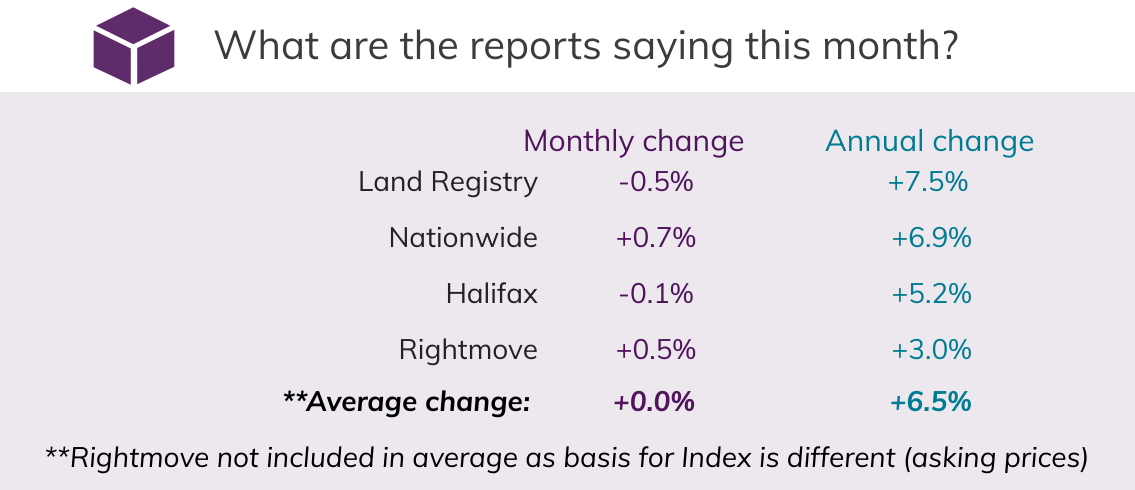

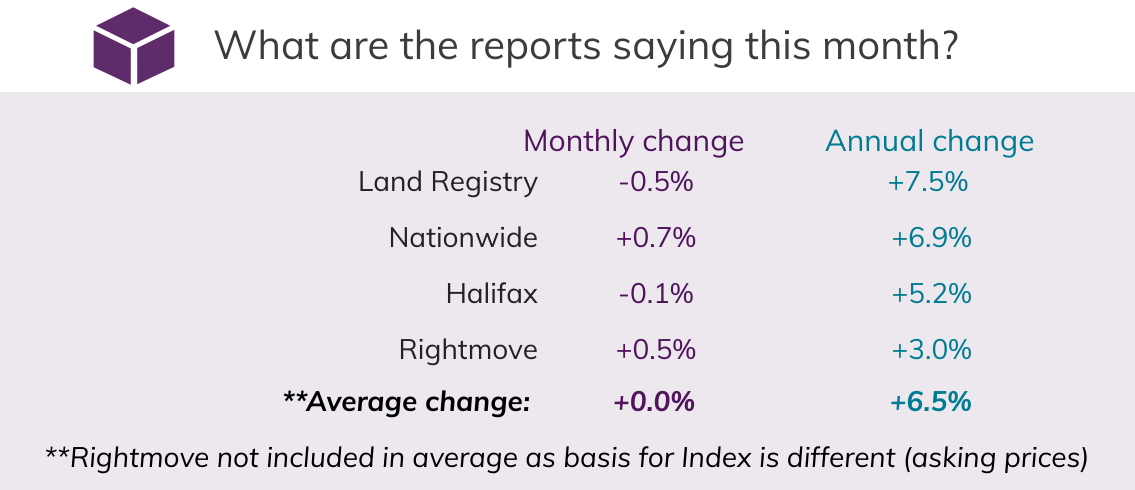

The Feb 2021 House Price Watch indicates house prices have been broadly stable over the past month. Nationwide (+0.7%) and Rightmove (+0.5%) report house prices up, while Halifax (-0.1%) reports a slight dip and, Land Registry, reporting January figures, indicates house prices fell -0.5% over the past month.

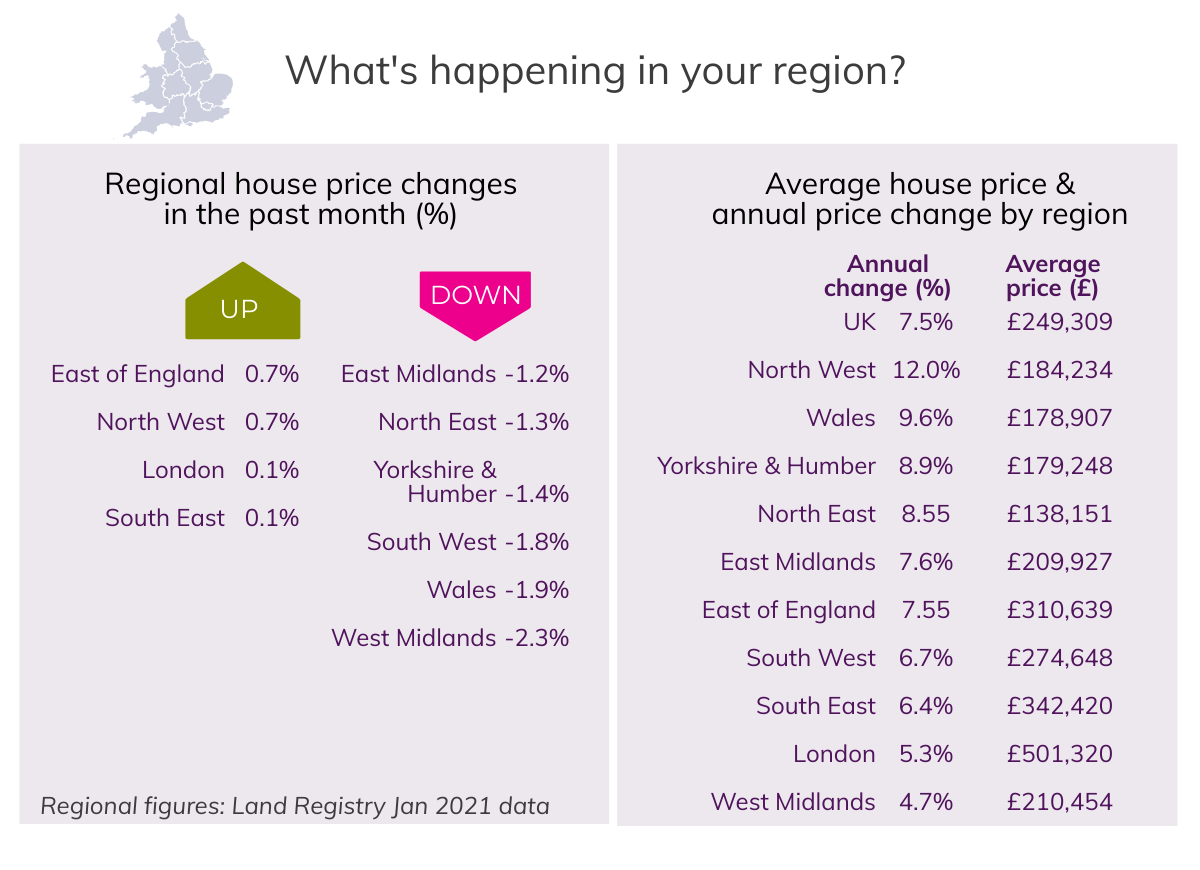

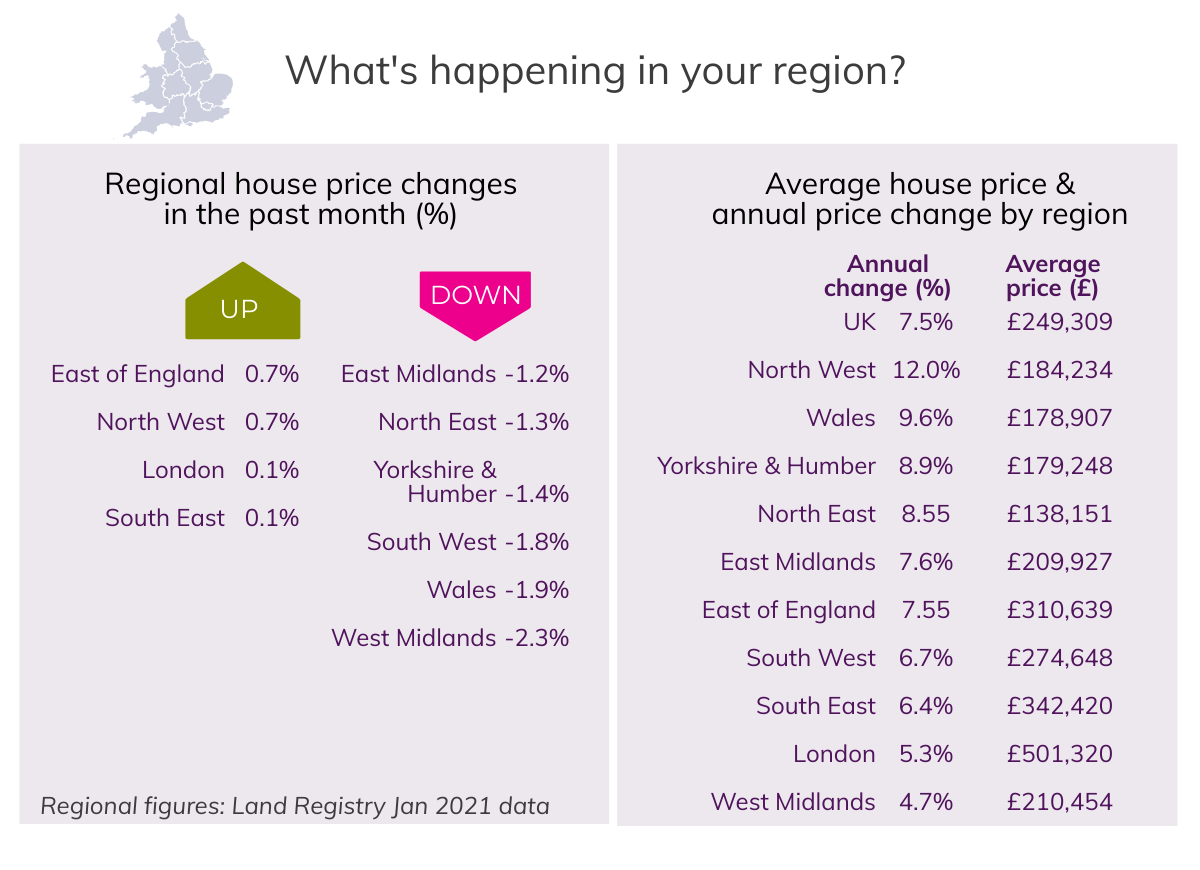

What’s happening in your area?

House prices are up over the past month in the North West, East of England, South East and London and down in other areas.

February completed home sales reach 14 year high. Buyer demand outpaces supply of homes for sale, likely to push house prices up.

February completed home sales reach 14 year high. Buyer demand outpaces supply of homes for sale, likely to push house prices up.

In the rush to complete before the expected end of the stamp duty holiday, completed UK home sales of 147k in February were the highest they have been in 14 years, up 23% on January and up 48% on February last year.

Buyers remain motivated to move with Rightmove saying enquiries are up 18% compared to last year. But the stock of homes available for sale is down with sellers likely deterred to list with current lockdown restrictions. Rightmove indicates new seller numbers are down 21% compared to last year. With demand outstripping supply, this will put upward pressure on house prices.

What the indices say

Rightmove: “Last year, the market was unexpectedly buoyed by buyers’ determination to move and satisfy their new lockdown-induced housing needs. We may well be seeing a continuation of that this year. Rightmove’s early 2021 buyer data shows that despite the imminent end of the stamp duty incentive, all of the key buyer metrics are ahead of early 2020, itself an active period as the market was boosted by the post-election ‘Boris bounce’. As well as the current lockdown motivating buyer demand again, the restrictions have also been a factor in limiting new supply, leading to some modest upwards price pressure.”

Halifax: “The housing market has been at something of a crossroads at the start of this year with upcoming events key to determining the path of activity and prices over the next few months. The government’s decision to extend the stamp duty holiday – one of the main drivers of demand during the pandemic – has removed a great deal of uncertainty for buyers with transactions yet to complete. The new mortgage guarantee scheme is another welcome development. Whilst mortgage approvals have reached record highs, raising a deposit continues to be the biggest hurdle for first-time buyers. Longer-term, the performance of the housing market remains linked to the health of the wider economy. The pace and extent of recovery are still highly uncertain.”

RICS: “Current lockdown restrictions appear to be deterring new vendors putting their homes up for sale. However, sales are expected to rise modestly over the coming three months. What’s more, it is important to note that over three-quarters of the survey sample was gathered prior to the Chancellor confirming that the Stamp Duty holiday would be extended until the end of June (and then tapered through to October) in the recent Budget.”

See previous House Price Watch reports and How we calculate the House Price Watch average

Related Reads

Show More Articles+

Show Fewer Articles−

How this site works

HomeOwners Alliance Ltd is registered in England, company number 07861605. Information provided on HomeOwners

Alliance is not intended as a recommendation or financial advice.

Mortgage service provided by London & Country Mortgages (L&C), Unit 26 (2.06), Newark Works, 2 Foundry Lane, Bath

BA2 3GZ, authorised and regulated by the Financial Conduct Authority (FRN: 143002). The FCA does not regulate

most Buy to Let mortgages. Your home or property may be repossessed if you do not keep up repayments on your

mortgage.

HomeOwners Alliance Ltd is an Introducer Appointed Representative (IAR) of Seopa Ltd, for home insurance,

authorised and regulated by the Financial Conduct Authority (FCA FRN: 313860).

HomeOwners Alliance Ltd is an Introducer Appointed Representative (IAR) of LifeSearch Limited, an Appointed

Representative of LifeSearch Partners Ltd, authorised and regulated by the Financial Conduct Authority. (FRN:

656479).

Independent Financial Adviser service is provided by Unbiased, who match you to a fully regulated, independent

financial adviser, with no charge to you for the referral.

Bridging Loan and specialist lending service provided by Chartwell Funding Limited, registered office 5 Badminton Court, Station Road, Yate, Bristol, BS37 5HZ, authorised and regulated by the Financial Conduct Authority (FRN: 458223). Your property may be repossessed if you do not keep up repayments on a mortgage or any debt secured on it.

February completed home sales reach 14 year high. Buyer demand outpaces supply of homes for sale, likely to push house prices up.

February completed home sales reach 14 year high. Buyer demand outpaces supply of homes for sale, likely to push house prices up.