Mar 2021 House Price Watch

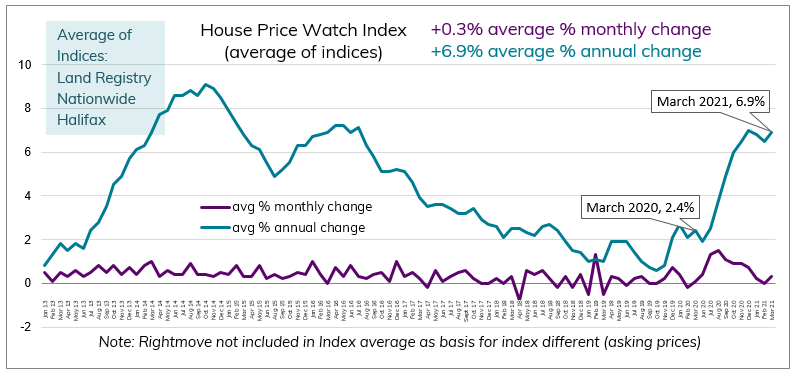

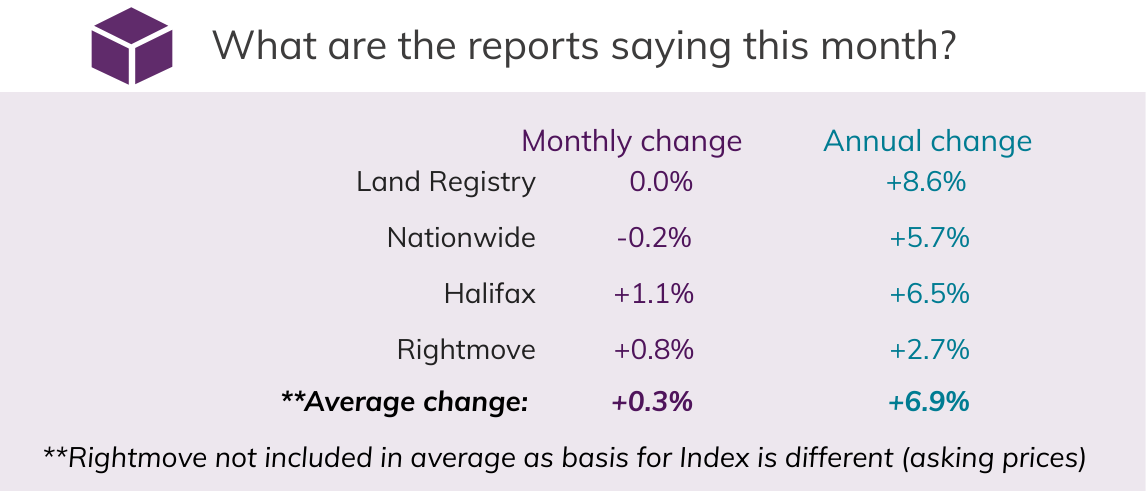

Completed home sales at record high. House prices up on average +0.3% this month and +6.9% this past year.

The rate of annual house price growth rose has risen steeply since March last year from 2.4% to 6.9%.

HomeOwners Alliance: “Transactions are at a record high this March, double the levels at this time last year. With the stamp duty holiday extension, as well as, the announcement of the new mortgage guarantee scheme, the housing market is likely to continue at pace. New sales listings are on the up this month but still lag the number of interested house hunters. As a result, we are likely to see rising house prices until the supply of homes for sale catches up with demand.”

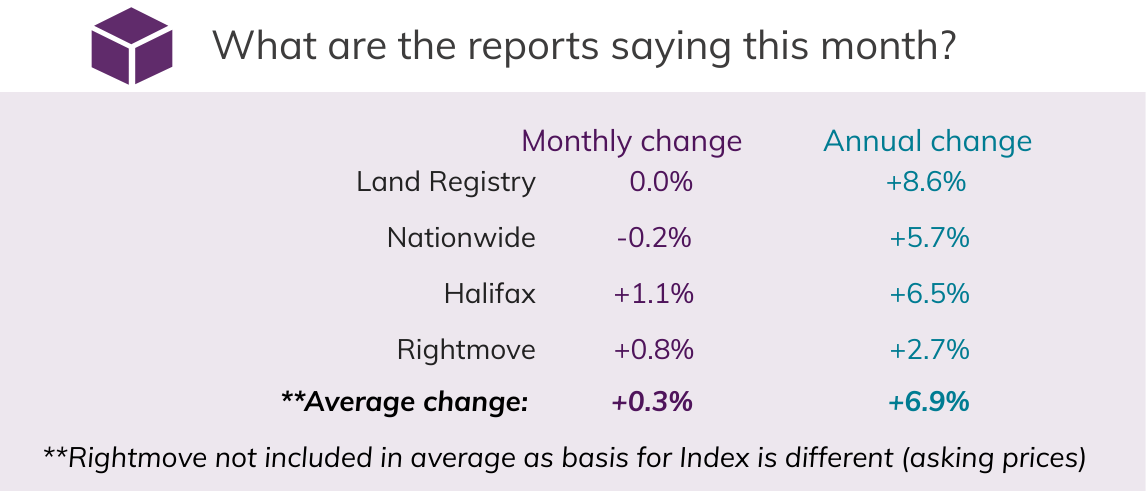

Across the indices, house prices are up +0.3% over the past month. Halifax (+1.1%), Rightmove (+0.8%), Nationwide (-0.2%) and, Land Registry, reporting February figures, indicates house prices are stable.

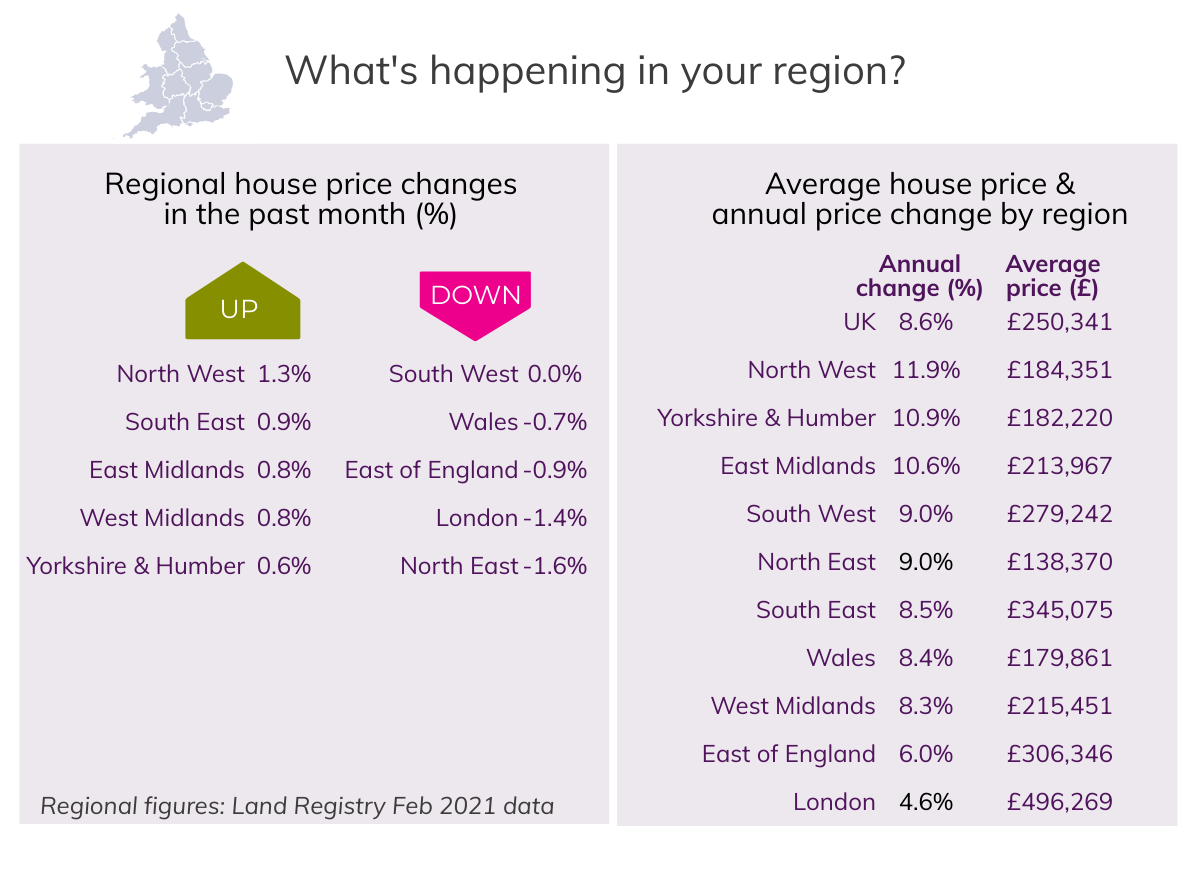

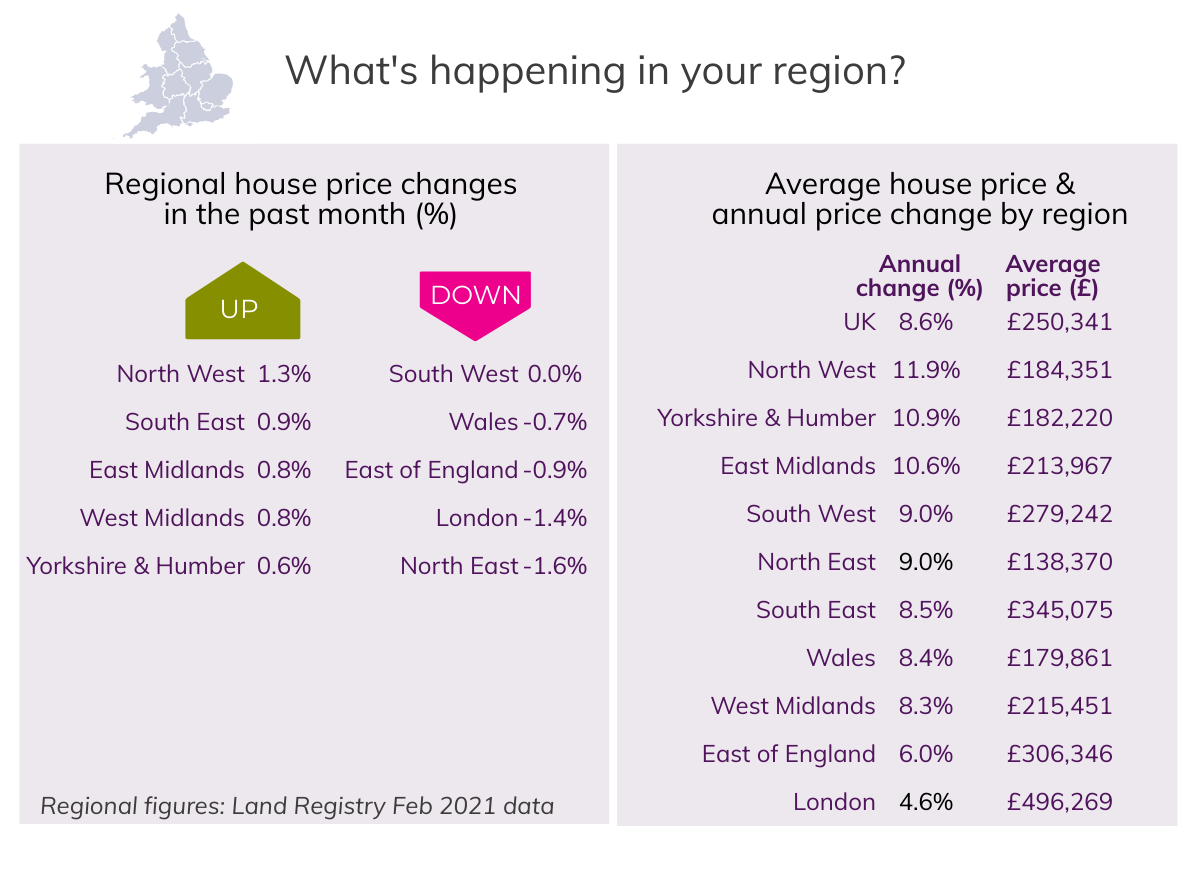

What’s happening in your area?

Annual house prices are up significantly in all areas of the country over the past year with the North West (+11.9%), Yorkshire & Humber (+10.9%) and the East Midlands (+10.6%) experiencing the biggest rises.

March home sales at record high.

UK home sales of 191K in March were at record levels, double the number of transactions last March (+102%) and up 24.5% on February, 2021.

Buyer demand outpaces homes available for sale, pushing up house prices.

Both enquiries and new instructions from sellers increased over the past month, although the availability of new homes for sale is not enough to match the pick-up in demand. Rightmove indicate that the number of potential buyers enquiring about each available property is at a record high. With sales already agreed for almost two out of three properties on agent’s books, buyers eagerly await fresh choice coming to market, making this the best sellers’ market of the past ten years. Rightmove also report that new listings are gaining momentum. With demand outstripping supply, this will put upward pressure on house prices in the coming months.

What the indices say

Halifax: “The continuation of government support measures has been key in boosting confidence in the housing market. The extended stamp duty holiday has put another spring in the step of home movers, whilst for those saving hard to buy their first home, the new mortgage guarantee scheme provides an alternative route onto the property ladder. Overall we expect elevated levels of activity to be maintained in the coming months, with consumer confidence spurred on by the successful vaccine rollout, and buyer demand still fuelled by a desire for larger properties and more outdoor space, as work-life priorities have shifted during the pandemic. A shortage of homes for sale will also support prices in the short term, as lower availability always favours sellers.”

Rightmove: “With demand being driven by the side effects of the lockdowns and the additional spur of government incentives, we anticipate further price rises during the traditional spring selling season. For those owners who are thinking of coming to market, the current excess of buyer demand over supply is the largest we’ve seen in the last ten years and suggests that this could be one of the best ever Easters to sell.”

Nationwide: “Recent signs of economic resilience and the stimulus measures announced in the Budget, including the extension of the furlough scheme and the stamp duty holiday, as well as the introduction of a mortgage guarantee scheme, suggest that housing market activity is likely to remain buoyant over the next six months.”

RICS: “The March 2021 RICS UK Residential Survey results show sales market activity picking up sharply over the month, with indicators on enquiries, sales and new instructions all improving noticeably compared to last time out. Survey participants highlight the extension of the Stamp Duty holiday as a significant driving force behind this renewed momentum, while a gradual loosening in lockdown restrictions is also said to be contributing to the rise in activity.”

See previous House Price Watch reports and How we calculate the House Price Watch average

Related Reads

Show More Articles+

Show Fewer Articles−

How this site works

HomeOwners Alliance Ltd is registered in England, company number 07861605. Information provided on HomeOwners

Alliance is not intended as a recommendation or financial advice.

Mortgage service provided by London & Country Mortgages (L&C), Unit 26 (2.06), Newark Works, 2 Foundry Lane, Bath

BA2 3GZ, authorised and regulated by the Financial Conduct Authority (FRN: 143002). The FCA does not regulate

most Buy to Let mortgages. Your home or property may be repossessed if you do not keep up repayments on your

mortgage.

HomeOwners Alliance Ltd is an Introducer Appointed Representative (IAR) of Seopa Ltd, for home insurance,

authorised and regulated by the Financial Conduct Authority (FCA FRN: 313860).

HomeOwners Alliance Ltd is an Introducer Appointed Representative (IAR) of LifeSearch Limited, an Appointed

Representative of LifeSearch Partners Ltd, authorised and regulated by the Financial Conduct Authority. (FRN:

656479).

Independent Financial Adviser service is provided by Unbiased, who match you to a fully regulated, independent

financial adviser, with no charge to you for the referral.

Bridging Loan and specialist lending service provided by Chartwell Funding Limited, registered office 5 Badminton Court, Station Road, Yate, Bristol, BS37 5HZ, authorised and regulated by the Financial Conduct Authority (FRN: 458223). Your property may be repossessed if you do not keep up repayments on a mortgage or any debt secured on it.